"Stronger is always stronger" this statement, in the sanitary ware track is only half right.

From 1993 to the present, the development of more than thirty years of sanitary ware track, the best-selling brands are still active in the current market. Nine herds three consecutive years of China's market share first; Huida from 2017 listed to 2021, revenue are maintained growth; Wrigley home furnishings not long ago officially landed in the capital market ......

The strong players of the past ran their own way in the sanitary ware track, but it's just a pity that they weren't that strong either. In the gongs and drums of the new trillion dollar market in the number of intelligent sanitary ware, sanitary ware track for decades has not even been born a 100 billion market value of the player.

Perhaps aware of this problem, unlisted nine pastor has been publicizing its "100 billion brand value", in 2022 in the global marketing development conference, the first to shout to break through 100 billion in revenue in 2030 slogan.

So, to be born in the sanitary ware market 100 billion revenue giants, what efforts still need to be made, can there be enterprises can run out in the industry?

Smart bathroom is a very important market.

With the popularization of intelligent devices, intelligent sanitary ware has become a new blue ocean in the sanitary ware track. According to the "China Intelligent Bathroom Industry Status Quo Depth Research and Future Investment Research Report" (2022-2029) released by GuanReport.com, the market size of China's smart home industry is expected to grow from 62 billion yuan to 217.5 billion yuan from 2016 to 2022.

Enterprises in the sanitary ware market have also begun to all move towards the path of digital intelligence ecology.

Wrigley stood on the wind of the smart home, recognized by the capital successfully listed, its toilet business is developing rapidly, the revenue of Wrigley Home in 2021 is 8.4 billion yuan, sanitary ceramics, that is, toilet business revenue of 3.7 billion yuan, accounting for 44.6%, Wrigley Home has also begun to move forward from the experts of the segmentation field towards the integrator of sanitary products, for example, in the field of intelligent toilet, sanitary ceramics, faucets, etc. Started to develop strength.

Hengjie is expanding faster and has a wider coverage, covering 400+ cities with 3,000+ sales outlets, and Hengjie has maintained a high intensity of innovation and market development on the basis of consolidating the traditional sanitary ware, such as making efforts in intelligent toilet.

Huida's advantage lies in the deep sinking market, by the end of 2021, the first and second tier stores accounted for 22%, and the third, fourth and fifth tier stores accounted for 78%, and it began to lay out the decoration business and set up the assembly decoration industry Internet platform - Huizhou.com. At the same time also in the wisdom of ecological force, Huida sanitary ware as early as 2017, said "the future of the company will be in the 'whole', 'wisdom', 'ecology' Three areas of comprehensive strength". According to the 2022 half-yearly report, Huida continued to invest in intelligent research and development in sanitary ware home, such as the introduction of intelligent toilets that can automatically control temperature.

Then, for example, Huida focuses on the layout of the ceramic field, according to the foreign media "Ceramic World Review Magazine" released 2021 annual ranking of the sanitary ceramics group, Huida as the only Chinese sanitary ware brand on the list of the top ten, the ranking is located in the seventh place. (Statistics only for listed companies)

Jiu Mu's core advantage lies in the production link in its supply chain, such as constructing an intelligent manufacturing industry chain, like the 101 Digital Factory, Jiu Mu West River Industrial Production Chain, and Jiu Mu combines cutting-edge technologies such as 5G, AI, and other cutting-edge technologies, and the world's first 5G intelligent toilet light factory, which can improve quality and increase efficiency, and reduce costs.

In this showdown on the sanitary ware track, no one company can pull the gap apart at present. According to 2022 Tmall and Jingdong Mall released the "kitchen and bathroom brand sales TOP10", Jiu Mu temporarily ranked first, Wrigley, Hengjie followed closely.

Intelligent sanitary track, is the core technology of the competition, like smart toilet remove the core size of hundreds of accessories, the quality of the good or bad actually depends on the electronic motherboard chip is good or bad, this part is actually the core technology, which is extremely test enterprise research and development capabilities.

As far as technology is concerned, the various enterprises are equally divided. Currently, in addition to self-research, Jiu Mu and Huawei in HarmonyOS reached a cooperation agreement, Wrigley also joined hands with Huawei HarmonyOS, Hengjie direct acquisition of Bo electric (smart toilet cover business), Huida and South Korea's first-class technology companies to cooperate in the establishment of electronic sanitary ware R & D center.

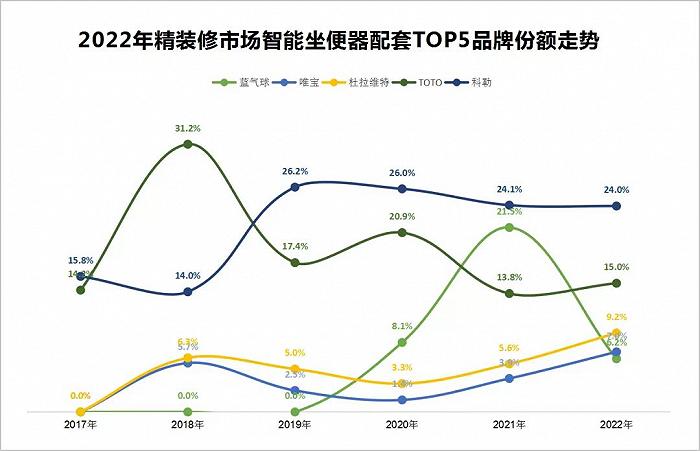

In addition, the biggest competition in intelligent sanitary ware comes from foreign brands. From the point of view of the most popular smart toilet, the TOP5 brands in the finishing market in 2022, the top four are foreign-funded, respectively, Kohler (24%), TOTO (15%), Duravit (9.2%), Villeroy & Boch (7%).

Post time: Jan-22-2024